Bonus paycheck calculator

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The average estimated annual salary including base and bonus at ADP is 85000 or 40 per hour while the estimated median salary is 88000 or 42 per hour.

What Are Marriage Penalties And Bonuses Tax Policy Center

Gross earnings per pay period Filing status.

. Or Select a state. All other pay frequency inputs are assumed to. Plug in the amount of money youd like to take home.

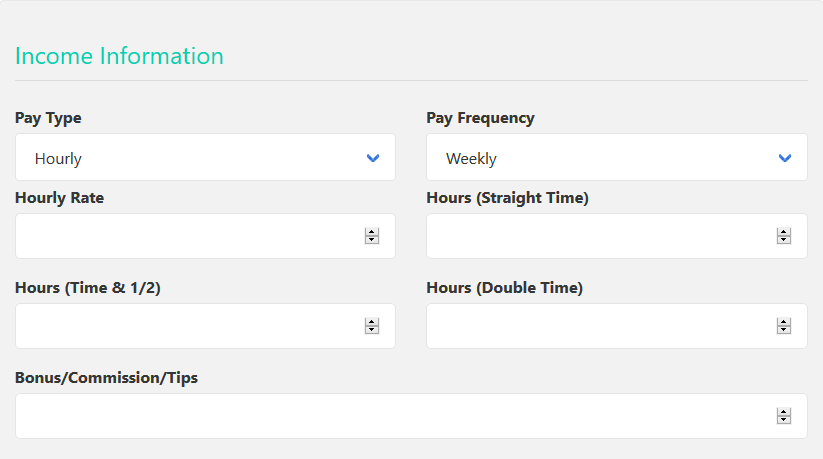

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Use this calculator to help determine your net take-home pay from a company bonus.

Federal Salary Paycheck Calculator. Ad Payroll So Easy You Can Set It Up Run It Yourself. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

This bonus tax aggregate calculator uses your last paycheck amount to apply the correct withholding rates to special wage. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All Services Backed by Tax Guarantee.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Get an accurate picture of the employees gross pay. Determine your annual income.

Bonus Pay Calculator Tool. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As many individuals do check your most current pay stub if you dont already know your annual wage. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

Important Note on Calculator. Use the number of pay periods in a year multiplied. It can also be used to help fill steps 3 and 4 of a W-4 form.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Amount of bonus Pay period frequency. Your employer withholds a 62 Social Security tax and a.

Federal Bonus Tax Aggregate Calculator.

Avanti Bonus Calculator

How Bonuses Are Taxed Calculator The Turbotax Blog

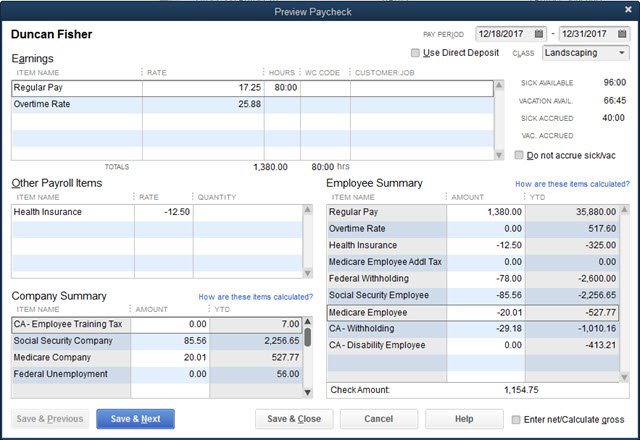

What If I Need To Pay Specific Amounts As A Payroll Holiday Bonus Insightfulaccountant Com

The Measure Of A Plan

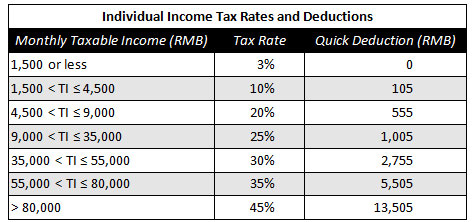

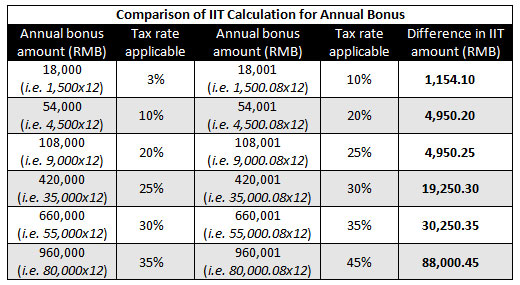

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Avanti Bonus Calculator

Everything You Need To Know About The Bonus Tax Method Rise

Calculate Bonus In Excel Using If Function Youtube

How Bonuses Are Taxed Calculator The Turbotax Blog

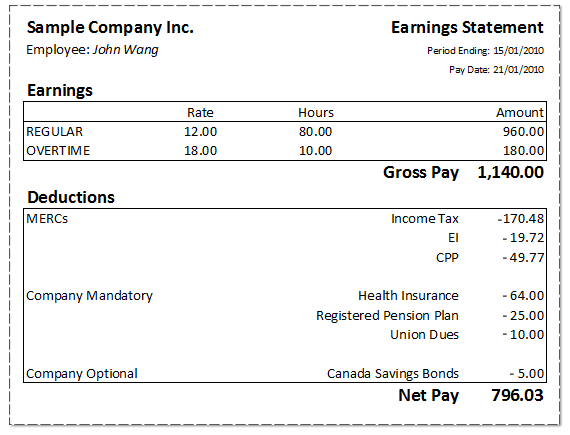

Free Paycheck Calculator Hourly Salary Usa Dremployee

How To Calculate Bonuses For Employees

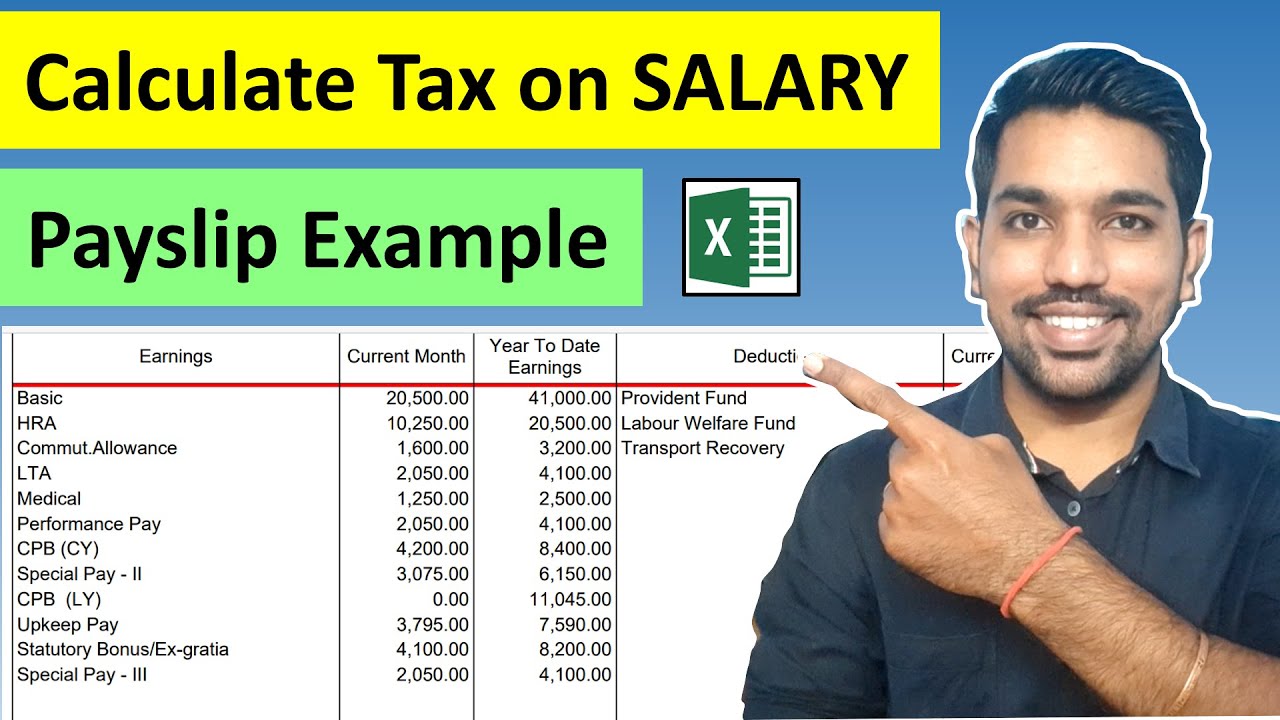

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Bonus Calculator Percentage Method Primepay

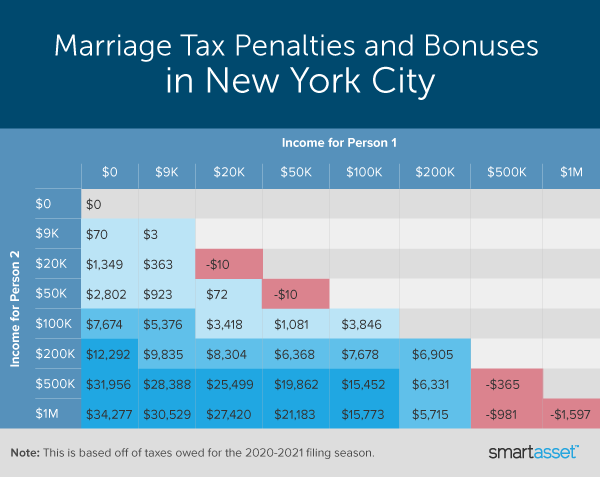

Marriage Penalty Vs Marriage Bonus How Taxes Work

What Is The Bonus Tax Rate For 2022 Hourly Inc

Management Bonus Accounting And Bookkeeping Protaxcommunity Com